Business Infrastructure Bureau, Keidanren

We appreciate the opportunity to submit our comments. We commend the many years of vigorous work by the OECD/IF (Inclusive Framework) to establish a new international tax system.

The Public Consultation Document (hereinafter "Document") considers the administrative burden on taxpayers in comparison with the "Blueprint" (October 2020). We note that formulaic allocation for tail-end revenues and components has been introduced based on the recognition that identifying the location of final customers is challenging. However, we believe that there is room for further improvement. We would like to provide the following comments bearing in mind the need to strike an appropriate balance between simplicity and accuracy.

We hope that these comments are helpful for the OECD to prepare the Commentary. This document is submitted by the Business Infrastructure Bureau, Keidanren, based on discussions at the "Corporate Liaison Group on Pillar 1 - Amount A"#1.

1. General Comments

1.1. Transaction-by-Transaction Approach and Internal Control Framework

1.1.1. Materiality threshold to narrow down the scope of record keeping and testing of systems

Article [X] 2 of the Draft Model Rules for Nexus and Revenue Sourcing (hereinafter "Model Rules") states that, in principle, revenues must be sourced on a transaction-by-transaction basis. And, with respect to documentation, "the Covered Group is not required to retain that data on every item" and "the approach to compliance would be at a systems level, and not at the individual transaction level" (footnote 3). This footnote is very important.

Multinational enterprises issue countless invoices, and it is not realistic to determine and document the source of revenue for every transaction. Transactions where the source of revenue is clear (e.g., simple domestic B2C transactions) should not be subject to documentation in the first place. In other words, simplified documentation should be required only where revenue-sourcing is difficult, such as cross-border transactions involving intermediate companies that supply goods or provide services to final customers. Having stated that, we are open to alternative way that is workable both for taxpayers and tax administrations.

1.1.2. Internal Control Framework

Audit by tax authorities should be at a systems level, i.e., whether the internal control framework is effectively established, as suggested in footnote 3. Sample examinations of individual transactions may be acceptable to a reasonable extent, but the obligation to provide comprehensive data should not be imposed. Enforcement by each country should be consistent. We look forward to the Commentary providing more detail on when the internal control framework can be said to be effectively established in relation to the selection of reliable methods and the collection of information required for revenue sourcing. In addition, it is necessary to clarify the relationship with existing laws and regulations pertaining to internal controls over financial reporting, such as the SOX Act in the U.S. and the Financial Instruments and Exchange Act in Japan. The materiality thresholds and the consequences of compliance or non-compliance (including preferential treatment or penalties) should be articulated for the purpose of internal controls under Amount A. We do not welcome penalties.

1.1.3. Prevention and resolution of disputes and transitional measures

Since MNEs, especially their ultimate parent entities, do not currently retain necessary data on their sources of revenue, new system investments would be required to comply with the rules, and it should be made very clear that it is NOT expected that each subsidiary would be required to revise contracts with customers.

First of all, it is desirable that the ambitious implementation schedule of the Pillar 1 be reconsidered. Even if this is difficult, it is essential to establish a prior consultation process with tax authorities (especially while the Covered Groups are developing their procedures and systems for compliance) as part of a multilateral early tax certainty process. The content of such consultations and solutions should be published as anonymized Q&A to promote consistent implementation by each country and to provide reference for Covered Groups.

It is also vital to refrain from overly strict enforcement until the new system is stabilized. Specifically, no penalties, delinquent taxes or interest should be imposed even if there are errors or delays in tax returns and payments. In addition, adjustments should be allowed in the current year tax return rather than requiring retroactive amendments to prior tax returns.

We would also like to reiterate that a mandatory and binding dispute resolution mechanism (including arbitration or similar systems) involving all IF member countries is imperative.

1.2. The meaning of "Revenue"

"Revenue" in the Model Rules should be "only" revenue recorded in consolidated financial statements based on the global accounting standards (IFRS, US GAAP, Japanese GAAP, etc.). The Amount A is a system that uses accounting figures as a starting point (rough justice). Revenues that are not recorded in the consolidated financial statements should not be "created" for the purpose of revenue sourcing (for an example, see comments 2. (5) below). We emphasize that this is a very important issue which directly impact the administrative burden of Covered Groups.

1.3. Supplementary transactions rules

For a supplementary transaction, the source of revenue is to be determined in accordance with the sourcing rule that applies to the main transaction. We understand this is a compromise to reduce administrative burden. However, we are still concerned that the rule is determined on a transaction-by-transaction basis.

For example, assume that sale of automobiles to customers is conducted by a dealer outside a Covered Group, and financing is provided by a subsidiary of the Covered Group. In this case, if we are required to obtain information from the dealer not only on revenues related to automobile sales by jurisdiction, but also broken down into "revenues combined with financing" and "revenues not combined with financing", and apply the supplementary transaction rule only to the "revenue combined with financing", the reduction in administrative burden may not be significant. It should be permissible to allocate the revenues from financing according to the ratio of the source of the overall revenues from automobile sales.

With respect to supplementary transactions, a quantitative segment-based de minimis rule should be established. For example, a Covered Group should be allowed to determine the source of revenue derived from a business segment representing less than 10% of total consolidated revenues in accordance with the sourcing rules that apply to the main business segment, irrespective of whether the Covered Group can differentiate supplementary transactions from main transactions.

1.4. Allocation Keys and Knock-out Rule

Where an independent distributor or a seller of finished goods into which a component is incorporated does not provide information on final customers, the use of an allocation key should be immediately allowed, on the ground that it meets the condition of an allocation key stated in Schedule A, Part 2, 6.b; "(the Covered Group) has taken reasonable steps to identify a Reliable Indicator and has concluded that no Reliable Indicator is available". If a Covered Group forces a supplier located downstream in the value chain to provide customer information, it may create a bad impression of the Covered Group with the supplier. This would benefit competitors of the Covered Group which do not require this sensitive information from the supplier. Such a requirement would be detrimental to the economic and competitive environment. Therefore, the rule should not compel the supplier to provide the information if the supplier refuses.

The Document describes a situation where an allocation key can be used in the absence of reliable indicators. Our understanding is that it is permissible to choose different approach for each Region. For instance, if there is a reliable indicator available for sales made in Europe, but no reliable indicator available for sales made in Africa, we understand the reliable indicator must be used in Europe, but the use of an allocation key as a reliable method would be permissible in Africa. We would like to confirm whether our understanding is correct.

In general, it seems difficult to apply the Knock-out Rule (i.e., to prove that there is no transaction) except for unusual and objectively clear cases such as where jurisdictions are subject to embargoes (footnote 39). An objective allocation key intended to be applied where the source of revenue is unclear would become a subjective test based on facts and circumstances, resulting in inconsistency. On the other hand, a Knock-in Rule (i.e., to prove that revenue does arise in a jurisdiction) may be more feasible, for example using VAT registration as proof of a business footprint in a jurisdiction. In any case, the application of the Knock-out Rule prior to adopting an allocation key should be optional for taxpayers, and additional explanation of how the Knock-out Rule will be applied should be provided.

2. Specific Issues

2.1. Finished goods

2.1.1. Direct Sales

2.1.1.1. Equipment used by service provider (Transportation refrigeration equipment)

It should be clarified how to determine the source of revenue when customers use finished goods in their business. For example, if a Covered Group which manufactures transportation refrigeration equipment sells equipment to a transportation company, which in turn uses the equipment to provide transportation services to other customers, we understand that the final customer for the Covered Group is the transportation company. We would like to confirm whether our understanding is correct.

Furthermore, if a Covered Group sells equipment to a leasing company, and the leasing company leases the equipment to a transportation company, which provides transportation services to other customers using the equipment, is it also correct to assume that the final customer for the Covered Group is the leasing company?

2.1.1.2. Manufacturing equipment

We understand that revenue from the sale of B2B manufacturing equipment is sourced to the location where the manufacturing equipment is installed and operated. We would like to confirm whether our understanding is correct in the following case:

- The Covered Group is a manufacturer of manufacturing equipment for electronic components and sells equipment to its customer which is an electronics component manufacturer (Manufacturer A)

- Manufacturer A uses the equipment to manufacture electronic components and supplies them to a manufacturer of finished goods into which the components are incorporated (Manufacturer B)

Is it correct to assume that the final customer for the Covered Group is Manufacturer A? Is it correct that there is no requirement to look through the long and complex supply chain to find the consumer of the ultimate finished product (which is likely to be impossible)?

2.1.2. Sales through an Independent Distributor

2.1.2.1. Reliable Indicators

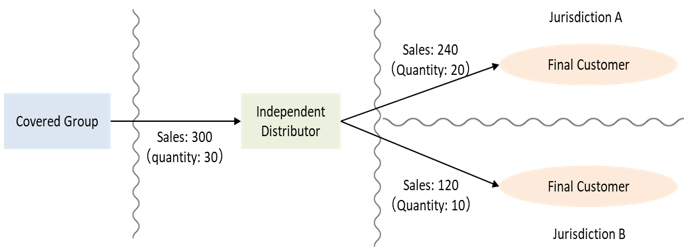

We understand that one of the indicators, the place of the delivery of finished goods to a final customer as reported to the Covered Group (Schedule A, Part 3, B 2. a.), includes information on the country of delivery (ship to) of the finished goods as agreed by a Covered Group in its contract with an independent distributor.

If this indicator is used, is it correct that the revenue generated by transactions with the independent distributor is allocated to each jurisdiction in proportion to the ratio of the revenue from transactions with final customers by the independent distributor?

Under the example illustrated above, we understand that the Covered Group's revenue in jurisdiction A is equal to 200 (=300 (revenue from a transaction with the Independent Distributor) x 240 (revenue from a transaction with Final Customer in jurisdiction A) / 360 (total revenue from transactions with Final Customers in jurisdictions A and B by the independent distributor)).

If so, we would appreciate additional explanations to the following questions;

- Where the Covered Group derives revenue from a transaction with Independent Distributor in period X and Independent Distributor sells finished products to Final Customers in period X+1, what should the Covered Group do in period X? We believe that the Covered Group cannot identify the source of revenue in period X.

- If the Independent Distributor does not provide a jurisdictional breakdown of its sales, can the Covered Group use a "Regional Allocation Key" to allocate its sales between Jurisdiction A and Jurisdiction B?

- If there is a change in the quantity of finished goods delivered to the final customer due to disposals of inventory recorded at Independent Distributor, how can these disposals be taken into account? For instance, if sales to Final Customer in Jurisdiction A do not change (sales: 240, quantity: 20), but sales to Final Customer in Jurisdiction B decrease (sales: 108, quantity: 9), is it permissible to use a figure of 108 in the calculation to allocate the revenues between jurisdictions?

- What adjustments should be made if the accounting periods of the Covered Group and Independent Distributor are different, such as where the Covered Group is a corporation with a fiscal year ending in March and the Independent Distributor is a business with a fiscal year ending in December?

We also welcome the inclusion of the location of the Independent Distributor as a reliable indicator. The Model Rules state that "The Location of the Independent Distributor, provided that the Independent Distributor is contractually restricted to selling in that Location or that it is otherwise reasonable to assume that the Independent Distributor is located in the place of the delivery of the Finished Goods to the Final Customer" (Schedule A, Part 3, B 2. b.) can be considered a reliable indicator. We understand that "reasonable to assume" includes the case where a Covered Group obtains a document from the Independent Distributor which verifies that finished goods are not sold outside the jurisdiction in which the distributor is located. In addition, as a transitional measure that is effective at least in the initial years of the rule, the jurisdiction where the Independent Distributor is located should be regarded as the source of revenue not only when it is clear that the independent distributor earns 100% of its revenue, but also when the independent distributor earns 95% or more of its revenue in that jurisdiction.

2.1.2.2. Allocation Keys

The definition of "Region" in the regional allocation key is independent of geographical proximity (Schedule A, Part 10, 18.). Therefore, we understand that any combination of multiple jurisdictions would fall under the category of "Region". We would like to confirm whether our understanding is correct. We look forward to specific examples being provided in the Commentary.

In addition, given that the scale of the tail-end revenue is unknown at present, the threshold regarding the tail-end revenue should be relaxed to, for example, 10% for an appropriate period after introduction of the rules. Also, the Model Rules allude to a provision for non-compliance in cases where reasonable steps are not taken to reduce tail-end revenue (footnote 16), however, penalties should not be applied as there are limits to the efforts that can be made to collect necessary information by Covered Groups.

2.2. Components

First, we would like to make it clear that materials such as steel do not fall under the category of components, and confirm whether there is a possibility that certain raw materials which partially fall under the category of "extractives" should be carved out.

With respect to components, such as general-purpose products, it is extremely difficult to identify the place of delivery to the final customer because components are incorporated into wide range of finished goods and their value chains are complex and long. There are various purchasers of components such as finished goods manufacturers, semi-finished goods manufacturers, wholesalers, etc. In such cases, the global allocation key should be allowed as a reliable method from the beginning, rather than solely as a backstop, on the grounds that a Covered Group in such a situation satisfies the condition for use of an allocation key set out in Schedule A, Part 2, 6., b.; "(the Covered Group) has taken reasonable steps to identify a Reliable Indicator and has concluded that no Reliable Indicator is available." Alternatively, it may be necessary to assume that a country to which a component is sold is the source of revenue if the revenue from component is insignificant compared to overall revenue.

2.3. Services

2.3.1. Mobile communication/data services with international mobility

Telecommunications are categorized as services tied to tangible property (Schedule A, Part 10, 51., c.), and fixed-line telephones seem to fall under this category, but there is a need for clarification on how to determine the source of revenue for mobile telecommunication/data services with international mobility (e.g., international roaming services and international use by lending mobile devices). In both B2C and B2B services, it is difficult to determine the location of final customers who move across borders during a contract period. In addition, the use of customers' location information is subject to restrictions on the protection of personal information.

As an alternative reliable indicator, we would suggest (1) that the revenue from mobile communication/data services, including those with international mobility, is generally considered to have been generated at the location of the purchaser at the time of the contract, or (2) that the revenue from mobile communication/data services with international mobility is considered to have been generated at the location of the service provider.

2.3.2. Online Advertising Services

The location of the viewer of the online advertisement is regarded as reliable indicator (Schedule A, Part 5, B., 2.). We would like to point out that technical and privacy issues need to be considered further in this regard.

2.3.3. Cloud Computing Services

For B2B services, there is a provision that the place of use of the service is deemed to be the source of revenue (Schedule A, Part 5, H, 2., a., b.). We expect additional explanations in relation to this provision. For example, if a Covered Group provides cloud computing services as a platform to a Large Business Customer (hereinafter "LBC"), and the LBC provides services to its customers using its own software on the platform, what is the "location of the services used by the business customers"? We consider that the address of the LBC stated in the contract with the Covered Group is a reliable indicator.

It is also stated that the Headcount Allocation Key may be used for a transaction with LBCs (Schedule A, Part 5, H, 5.). How should we deal with a case where cloud computing services are used by persons other than employees of the LBC? Is the Headcount Allocation Key also to be used in cases where only a few divisions (accounting, human resources, etc.) of the LBC use the cloud computing services? Cloud computing is by nature a location-free service and Headcount Allocation may not be helpful in some instances.

In any case, it is considered difficult to use the number of employees as an allocation key for all services, including cloud computing services, due the restrictions on the availability of data. This applies even if the customer is a public company. We further note that non-LBCs may become LBCs and vice-versa depending on business performance in a given year, or as a result of business reorganization. The LBC criteria is subject to variability in our view.

There is a provision regarding B2B services sold through a reseller (Schedule A, Part 5, H, 8.-10.). The meaning of "reseller" should be clarified. As illustrated in the above case, if the LBC adds its own services to the cloud computing services provided by the Covered Group and provides such additional services to its customers, our understanding is that the LBC is not considered a "reseller" according to the definitions in the Model Rules (Schedule A, Part 10, 49.). We would like to confirm whether our understanding is correct.

The criterion for a non-LBC is that "the total invoice amount for services provided to a Business Customer does not exceed EUR [1-3] million in the period" (Schedule A, Part 10, 36.). This is not considered to be meaningful for a Covered Group with turnover exceeding EUR 20 billion, and we believe the threshold value could be higher.

2.3.4. Corresponding Application of the Non-LBC provision to finished products and components

In the case where no reliable indicator is available for B2B services and the business customer is not an LBC, there is a provision that the place of incorporation of the Ultimate Parent Entity of the business customer is deemed to be a Reliable Indicator (Schedule A, Part 5, H, 4.a.). This provision should also be applied to finished goods and components to some extent. It is necessary to simplify information collection from small business partners in the sale of goods as well as in the provision of services.

2.4. Intangible Property

In the pharmaceutical industry, there are three main stages leading up to the sale of a finished pharmaceutical product: research (pre-clinical trial stage), development (clinical trial and application for approval), and sales. At each stage, intangible assets can be the subject of transactions.

For example, when considering the pharmaceutical licensing out of a compound at the post-research, a single contract with a customer generates several different types of payments: upfront payments, milestone payments#2, and royalties on sales. Whilst royalties on sales can be considered clearly tied to the final product, the upfront payments and milestone payments are not necessarily tied to the final product because the final product has not yet been sold when the revenue is realized, and the contract may be terminated due to cancellation of the development project. As a result, we believe that it is necessary to consider licensees of the compound as the final customer in case of upfront and milestone payments, and require only that the Covered Group provides evidence to support this state of affairs. Further explanation should be provided.

2.5. Government Grants

Government subsidies and tax incentives are sometimes recorded as a negative expense for accounting purposes. In such cases, they should not be treated as revenues for the purpose of revenue sourcing under Amount A.

2.6. Transactions that require additional guidance

The global allocation key is recognized as a backstop in components, B2B services sold through resellers, and intangible property. Which category do the following cases fall under? Also, in the absence of a reliable indicator, can a global allocation key be applied? We look forward to the inclusion of explanatory case studies in the commentary.

- A musical work of a Covered Group is used as a soundtrack for a film that is produced by third party studio and released at theaters.

- IP license is provided to a third party that sells products (merchandise, etc.) related to a Covered Group's film, game products, or contents.

- Video assistant referee services are provided by a Covered Group in multiple countries (but the host country is undetermined at the time of the contract) under a single contract in support of sports events (such as international football matches).

- TV programs are produced by journalists and editors on a location-free basis on a B2B platform with respect to which a Covered Group provides cloud service.

2.7. Others

We understand that the term "a person" as used in the definitions (Schedule A, Part 10, 3., 5., 6.) includes not only individuals but also companies, etc., in the same way as "person" in Article 3(1)(a) of the OECD Model Tax Convention on Income and Capital 2017. We would like to confirm whether our understanding is correct.

- This is an informal study group, formed in 2021, of MNEs headquartered in Japan that exceed or are expected to exceed the Amount A thresholds (20 billion € in turnover, 10% profit before tax/revenue). The group consists of tax directors from automobiles, auto parts, electronics, IT, telecommunications, pharmaceuticals, air conditioning, steel, trading companies, EY Japan, Keidanren, and others.

- The term "milestone payment" refers to a payment linked to a certain stage in the development and approval process of a drug. Usually, contracts stipulate milestone payments at multiple stages in the development process.